real property gain tax

Real Estate Calculator Terms Definitions. Shares and similar investments Check if you are an investor or trader and how it affects tax on your shares or units in.

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Enter the total real estate taxes for the real property tax year.

. Typically websites like Redfin. The Foreign Investment in Real Property Tax Act of 1980 FIRPTA enacted as Subtitle C of Title XI the Revenue Adjustments Act of 1980 of the Omnibus Reconciliation Act of 1980 Pub. Real Estate Property consisting of land or buildings.

Long-term capital gain tax rate as well as how to avoid capital gains tax as much as possible if you believe your assets will be subjected to it. A 1031 exchange allows real estate investors to swap one investment property for another and defer capital gains taxes but only if IRS rules are met. If you sell your rental property for 350000 it may seem like a loss but it is actually a 50000 gain for tax purposes.

Educate yourself invest wisely and design a strategic plan of action that includes real estate as part of your overall wealth plan here. We will also discuss capital loss and how it works to offset the Capital Gains Tax. News for Hardware software networking and Internet media.

The measure shows the convoluted extremes that Californias tangled property tax system produces Los Angeles Times Editorial Board. When it comes to searching the tax history on a property you have a few options. In this article we will explore the real estate capital gains tax short-term vs.

In addition to that you will learn about the ways to. You will learn about the types of taxes you have to pay. Even if rental real estate rises to the level of a section 162 trade or business it is generally reported on Schedule E Part I because rental real estate is generally excluded from self-employment taxable income under section 1402a1.

Qualified investment entities QIEs. Multiply line 1 by line 3. But Proposition 19 would just expand the inequities in Californias property tax system.

Capital gain is generally a gain on sale of capital assetsthat is those assets not held for sale in the ordinary course of business. Real estate agents and real estate brokers are required to be licensed when conducting real estate transactions in the United States and many other countries. The gain is considered an unrecaptured section 1250 gain and it is.

Capital gains tax is the amount of tax owed on the profit aka the capital gain you make on an investment or asset when you sell it. This guide explains all tax implications of selling a commercial property. Real Property Gain or Loss.

30K Depreciation Generally taxed at 25 rateIn this example an investor pays 11100 if 5 capital gains tax rate or 18300 if 15 capital gains tax rate in taxes on a 102K gain. Real estate investing is not a get-rich-quick scheme and it can take decades before you see results. Real estate licenses authorizations issued by state governments give agents and brokers the legal ability to represent a home seller or buyer in the process of buying or selling real estate.

Federal Capital Gains Tax CGT long-term and short-term state taxes and depreciation recapture. A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning. With FortuneBuilders helpful guide real estate investors and property owners can feel confident heading into the.

An additional tax from 2 to 6 depending on the amount of the capital gain after applying the reduction applies to capital gains on property other than on building land of an amount higher than 50000. The capital gains resulting from transfers carried out since January 1 2013 are concerned. 5 1980 is a United States tax law that imposes income tax on foreign persons disposing of US real property interests.

The IRS allows taxpayers to defer a portion of the gain on the sale of an investment property with an installment sale agreement that can reduce the sellers taxes on the profit. A transition rule in the new law provides that Section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before December 31 2017 or received replacement property. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange.

By accounting for all selling costs and improvements the investor saved from 3K to 5K in taxes depending upon their tax bracket. You cannot deduct a loss from the sale of your main home. Divide line 2 by 365.

Tax is imposed at regular tax rates for. Most jurisdictions imposing an income tax treat capital gains as part of income subject to tax. Enter the number of days in the property tax year that you owned the property.

Rental real estate is usually reported on Schedule E Part I and is not subject to self-employment tax. Real property holding corporation. Property and capital gains tax How CGT affects real estate including rental properties land improvements and your home.

Worksheets are included in Publication 523 Selling Your Home to help you figure the. If property was acquired on an exchange described in this section section 1035a section 1036a or section 1037a then the basis shall be the same as that of the property exchanged decreased in the amount of any money received by the taxpayer and increased in the amount of gain or decreased in the amount of loss to the taxpayer that was recognized on such exchange. It is calculated by subtracting the assets original cost or.

Look-through rule for QIEs. Reporting on information technology technology and business news. Disposition of REIT stock.

You essentially make a capital gain when the difference between the cost of purchasing your property or another asset and what you gained from selling it is greater than zero - in other words you made a profit. Enter it on Schedule A Form 1040 line 5b. Below you will find four different ways to conduct your property tax history search.

It favors one narrow segment of the tax-paying public but does nothing for the rest of the states home buyers. A common type of property tax is an annual charge on the ownership of real estate where the. 10 States with No Property Tax in 2020.

This is the quickest most common approach used to look up property tax history. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. This is your deduction.

Each state requires its own. If you have a gain from the sale of your main home you may be able to exclude up to 250000 of the gain from your income 500000 on a joint return in most cases. Investment property is real estate property that has been purchased with the intention of earning a return on the investment either through rental income the future resale of the property or.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Real Property Gains Tax Part 1 Acca Global

New Capital Gains Tax On Real Estate 2018 Norada Real Estate

Az Big Media How To Avoid Capital Gains Tax On Investment Properties Az Big Media

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

Real Property Gains Tax Rpgt In Malaysia 2022 Bentongland

Subsaleking Darren Wong Sinland Real Estate Facebook

All You Need To Know About Real Property Gains Tax Rpgt

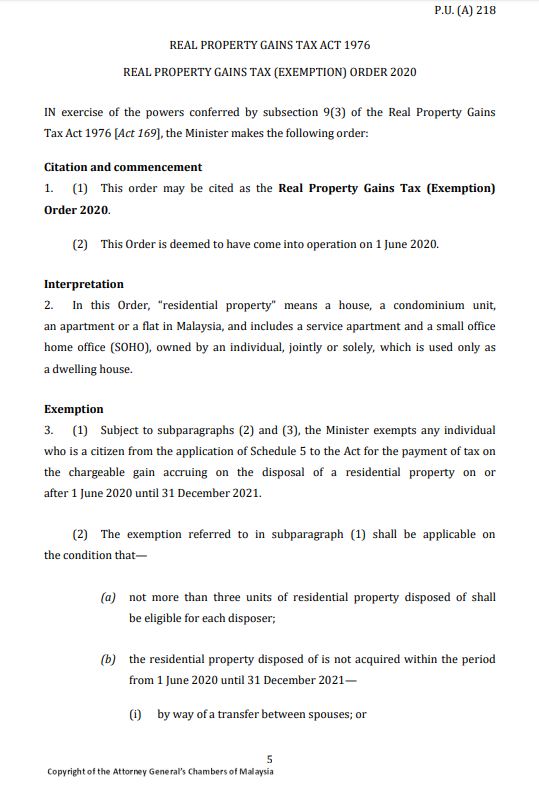

Real Property Gains Tax Exemption Is Now Gazetted Penang Property Talk

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

Real Property Gains Tax Rpgt In Malaysia Malaysia Property Update

What Is Real Property Gains Tax The Star

Key Changes In The Real Property Gain Tax Cheng Co Group

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Capital Gains On Selling Property In Orlando Fl

Comments

Post a Comment